What is the Massachusetts Estate Tax and will I have to pay it?

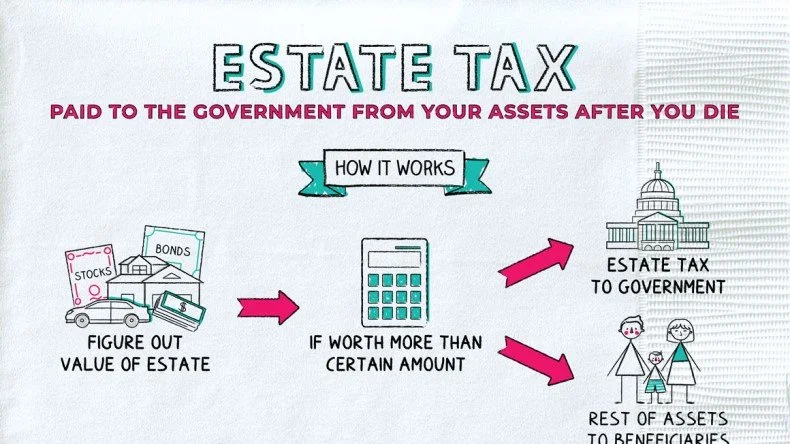

There is a running joke in Massachusetts that it is one of the most expensive states to die in. Although this may be a joke to some it becomes a reality for others. Many people do not realize how they could possibly be taxed by Massachusetts after their death. Massachusetts’ estate tax threshold is one million (1,000,000.00) dollars. Many people look at their own possessions and the amount of money that they make and think to themselves that they do not have anything close to a million dollars in assets to tax. Well, the truth is in order to make the calculation you need to know what possessions and accounts equal your estate.

The largest amount of money that most people forget to add into their estate is a life insurance policy. If someone has a one-million-dollar life insurance policy they are already exceeding the Massachusetts estate tax. It is important to note that if an individual exceeds the one-million-dollar threshold they will have to pay a tax on the entire amount of money, not just the amount of money that brings them over the threshold. The average amount of taxes a person will pay after death is sixty-five thousand dollars. ($65,000.00) if they do not prepare for this tax. Imagine having a home worth four hundred thousand and a one-million-dollar life insurance policy. The individual will be taxed on the entire one million four hundred thousand dollars. ($1,400,000.00). These are numbers that could cripple a family if they do not properly prepare for death.

If you have a life insurance policy and want it to remain outside of your estate the best approach to take is to place it into an irrevocable life insurance trust. This process will take the life insurance policy out of your estate. It also allows you to use the life insurance proceeds tax free. This is a relatively simple process which can save you close to sixty-five thousand dollars ($65,000.00) in estate tax upon your death. If you would like to learn more about estate taxes and want to plan for your future contact us and let us help you plan for the inevitable… death and taxes.

Until next time…

Prepare a plan and start thinking about the future because tomorrow is never guaranteed.

Joshua D. Melo, Esq.